The beer business – which has grown to more than 300 breweries around Colorado – is starting to look a little frothy.

One early sign: prices are starting to drop.

Buyer Dan Chacon at Denver’s Argonaut Wine and Liquor said craft beer sales are starting to level out, which has caused several labels to drop prices on six-packs from 50 cents to $1.

The Wall Street Journal also reported last month that Anheuser-Busch is aggressively using newly acquired craft breweries, such as Breckenridge Brewery, to undercut the liquor stores and bar taps, which has led to a drop in sales for some of the nation’s largest craft breweries including Sam Adams and Sierra Nevada.

Since 2011, when the makers of Budweiser bought Goose Island Brewery in Chicago, Anheuser-Busch has acquired 10 craft brewers across the nation. And Goose Island has started to cause problems for some of Colorado’s independent brewers looking to sell kegs.

Patrick Crawford from the Denver Beer Co. said lower keg prices from Goose Island has made it difficult to sell IPA kegs at optimal prices. Dave Thibodeau, co-founder and of Durango’s Ska Brewing, said the company already has lost tap handles in the Front Range when bars opted for the lower-priced competitor Goose Island IPA. He said keg sales for Goose Island have dropped to “much less than we’re able to produce (our IPA).”

Ska Brewing produced just over 34,000 barrels last year. The company sits in the same production range as Great Divide Brewing Co., which produced 35,300 barrels in 2016 – a 19 percent drop from 2015, according to the Boulder-based Brewer’s Association, which works with beer companies nationwide.

Both are top-10 craft beer producers in the state, along with New Belgium Brewing, Oskar Blues Brewery, Odell Brewing Co. and Left Hand Brewing Co.

“We’re not scaled to compete on price with breweries that have been purchased by Budweiser,” Thibodeau said. “There’s almost nothing that breweries like us can do.”

The Colorado craft beer market has been booming. The state had 235 craft breweries in 2014, according to data from the Brewer’s Association. Two years later, Colorado came in second place after California as the state with the most craft breweries. The Brewer’s Association listed 334 in Colorado, producing 1.4 million barrels of beer in 2016.

Kevin Selvy, founder and CEO of Crazy Mountain Brewing Co., said the increased number of competitors means craft brewers need to be more savvy business operators and not just beer lovers. Many liquor stores have a small amount of shelf space, and if one kind of beer doesn’t do well, there’s plenty of brands to replace it.

“You can’t sit back and watch your sales grow. You have to go out there and be proactive,” he said. “Once you get the shelf space, your products have to move. If you don’t really perform, you’re going to lose those shelf placements.”

Canning has become an easier process for brewers as well. Technology improvements over the last five years has made canning equipment both smaller and less expensive for brewers. Equipment that used to set brewers back nearly $500,000 now can be purchased for between $50,000 and $60,000. Brian England, CEO of Eddyline Brewing LLC, said his company sells 16-ounce cans in six-packs in order to stay competitive.

“You can be the smallest guy, and still get a product on the shelf,” he said.

Many Colorado breweries said building relationships with distribution accounts like local bars and liquor stores helped keep their beers ahead of the competition.

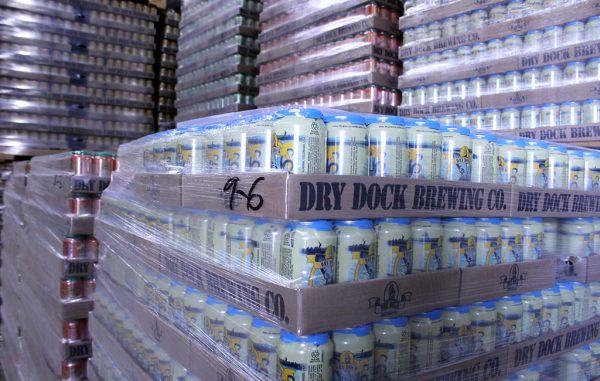

George Allen, director of sales and marketing for Dry Dock Brewing Co., said the company has more than 1,000 accounts in its distribution network, which represents most of the company’s revenue. He said Dry Dock has to strike a balance between bringing new customers in through its two Aurora tasting rooms and keeping retail accounts happy with quality beers. The brewery focuses on the Colorado market, and does not distribute out of state.

“When you take certain breweries and they get bought out by a larger organization then they can cut prices because of the economies of scale and things like that. We can’t play that game and we’re not going to play that game. It doesn’t make sense for us,” Allen said.

The beer business – which has grown to more than 300 breweries around Colorado – is starting to look a little frothy.

One early sign: prices are starting to drop.

Buyer Dan Chacon at Denver’s Argonaut Wine and Liquor said craft beer sales are starting to level out, which has caused several labels to drop prices on six-packs from 50 cents to $1.

The Wall Street Journal also reported last month that Anheuser-Busch is aggressively using newly acquired craft breweries, such as Breckenridge Brewery, to undercut the liquor stores and bar taps, which has led to a drop in sales for some of the nation’s largest craft breweries including Sam Adams and Sierra Nevada.

Since 2011, when the makers of Budweiser bought Goose Island Brewery in Chicago, Anheuser-Busch has acquired 10 craft brewers across the nation. And Goose Island has started to cause problems for some of Colorado’s independent brewers looking to sell kegs.

Patrick Crawford from the Denver Beer Co. said lower keg prices from Goose Island has made it difficult to sell IPA kegs at optimal prices. Dave Thibodeau, co-founder and of Durango’s Ska Brewing, said the company already has lost tap handles in the Front Range when bars opted for the lower-priced competitor Goose Island IPA. He said keg sales for Goose Island have dropped to “much less than we’re able to produce (our IPA).”

Ska Brewing produced just over 34,000 barrels last year. The company sits in the same production range as Great Divide Brewing Co., which produced 35,300 barrels in 2016 – a 19 percent drop from 2015, according to the Boulder-based Brewer’s Association, which works with beer companies nationwide.

Both are top-10 craft beer producers in the state, along with New Belgium Brewing, Oskar Blues Brewery, Odell Brewing Co. and Left Hand Brewing Co.

“We’re not scaled to compete on price with breweries that have been purchased by Budweiser,” Thibodeau said. “There’s almost nothing that breweries like us can do.”

The Colorado craft beer market has been booming. The state had 235 craft breweries in 2014, according to data from the Brewer’s Association. Two years later, Colorado came in second place after California as the state with the most craft breweries. The Brewer’s Association listed 334 in Colorado, producing 1.4 million barrels of beer in 2016.

Kevin Selvy, founder and CEO of Crazy Mountain Brewing Co., said the increased number of competitors means craft brewers need to be more savvy business operators and not just beer lovers. Many liquor stores have a small amount of shelf space, and if one kind of beer doesn’t do well, there’s plenty of brands to replace it.

“You can’t sit back and watch your sales grow. You have to go out there and be proactive,” he said. “Once you get the shelf space, your products have to move. If you don’t really perform, you’re going to lose those shelf placements.”

Canning has become an easier process for brewers as well. Technology improvements over the last five years has made canning equipment both smaller and less expensive for brewers. Equipment that used to set brewers back nearly $500,000 now can be purchased for between $50,000 and $60,000. Brian England, CEO of Eddyline Brewing LLC, said his company sells 16-ounce cans in six-packs in order to stay competitive.

“You can be the smallest guy, and still get a product on the shelf,” he said.

Many Colorado breweries said building relationships with distribution accounts like local bars and liquor stores helped keep their beers ahead of the competition.

George Allen, director of sales and marketing for Dry Dock Brewing Co., said the company has more than 1,000 accounts in its distribution network, which represents most of the company’s revenue. He said Dry Dock has to strike a balance between bringing new customers in through its two Aurora tasting rooms and keeping retail accounts happy with quality beers. The brewery focuses on the Colorado market, and does not distribute out of state.

“When you take certain breweries and they get bought out by a larger organization then they can cut prices because of the economies of scale and things like that. We can’t play that game and we’re not going to play that game. It doesn’t make sense for us,” Allen said.

Nice story. Thanks.